WinVAR

Value at Risk

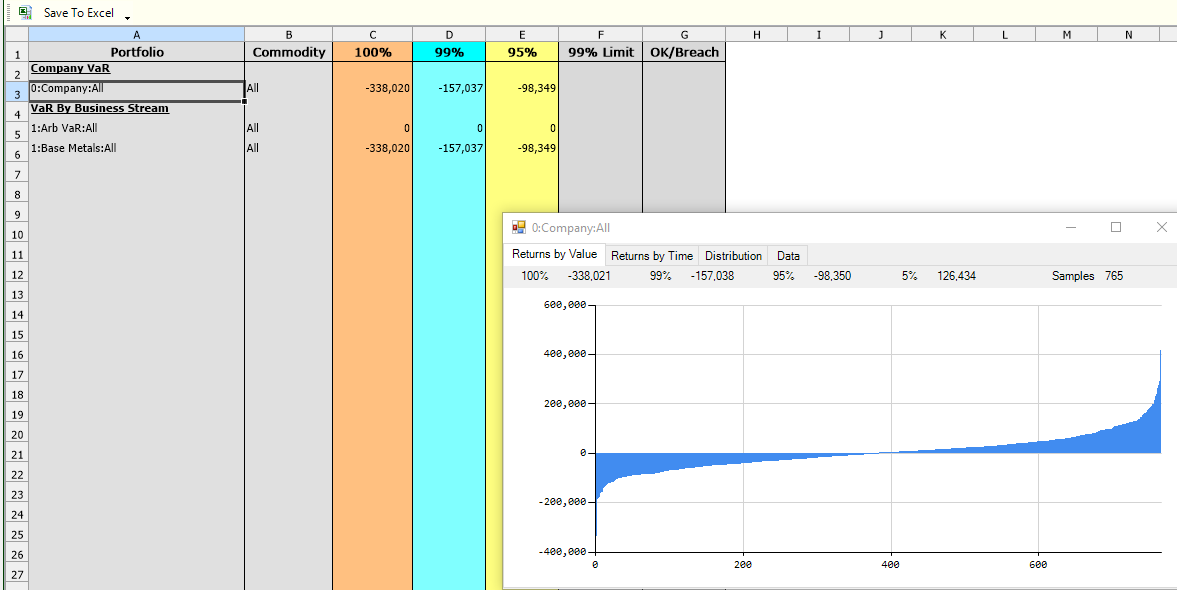

WinVaR is a component based Value at Risk (VaR) system specifically designed to handle the unique market requirements of those enterprises using commodity based contracts as part of their trading portfolio. At its core is WinRisk’s Value at Risk calculation engine, which has been successfully deployed at a number of trading companies.

WinVaR handles all commodity based futures and forward instruments (including LME) and has been developed over a 10 year period in conjunction with a number of commodity trading houses and financial institutions.

WinVaR can be configured to adopt any of the following methods;

- Historical simulation (Default and recommended)

- Monte Carlo

- Parametric

WinVAR has been developed to handle not only raw market volatility but also markets which have inherently large calendar spread risk. Most commodities exhibit such tendencies. Typically, the system may employ Monte Carlo (MC) or Historic Simulation (HS) techniques and can use full trade revaluation or Delta/Gamma/Vega revaluation. The system will cope with inter and intra market correlation either through variance/covariance in the case of Monte Carlo or the stochastic correlation which occurs naturally in the historic simulation VaR arrays. VaR can be calculated on the prime portfolios, desks, by commodity, business stream and finally by the total company.

VaR is not always easy to analyse, especially in a complex portfolio of inter and intra market spread exposures. WinVAR provides three analytical tools to aid the user in quickly analyse the risk.

Portfolio amendment – Here the user can add, delete and amend positions to determine where the VaR might be generated, as well as what trades might be used to reduce the risk. Changes can be made and the VaR can be very quickly recalculated.

VaR change analysis – Here the analysis shows, the change in the VaR since the previous run, the change by portfolio, and the price change that caused the risk to be generated.

Simple Position analysis – Here the user can enter simple outright or spread trades and view the associated risk, without adding a complex portfolio of trades.